Bitcoin Is Green Energy

And It's Incredibly GOOD For the Environment

When I was a teenager, I visited Jamaica. One of the many things I learned about that beautiful place was that they export a lot of orange dirt to Iceland.

I learned that what makes that orange dirt special was that it is bauxite, an aluminum-bearing ore. But why was Jamaica shipping aluminum ore to Iceland? Because Iceland had (and still has) extremely cheap electricity, and it takes a LOT of electricity to free aluminum from the oxygen it’s bonded to in bauxite. A typical LED light bulb in your house uses around 8 Joules per second (8 Watts). To liberate just one kilogram of aluminum from bauxite ore, it takes about 50 million Joules, or about the energy to run that light bulb for over two months.

This is why Iceland is a major destination for aluminum smelting. But it also demonstrates a very different way to think of Iceland’s massive refined aluminum exports: Iceland is, in essence, exporting energy — but in the form of refined aluminum.

In almost exactly the same way, Iceland has developed a new and very important export: Bitcoin.

As most readers will likely already know, Bitcoin is a cryptocurrency that can be “mined” by setting specialized computers to solve mathematical decryption tasks. When one of those is solved correctly, an amount of Bitcoin is granted to the account running that computer, and this knowledge of the ownership of the newly minted Bitcoins percolates automatically through the entire network of all Bitcoin miners and users so that almost everyone knows who owns which Bitcoins in a way that is stored in that distributed network.

Basically, Bitcoin miners turn electricity into a store of wealth.

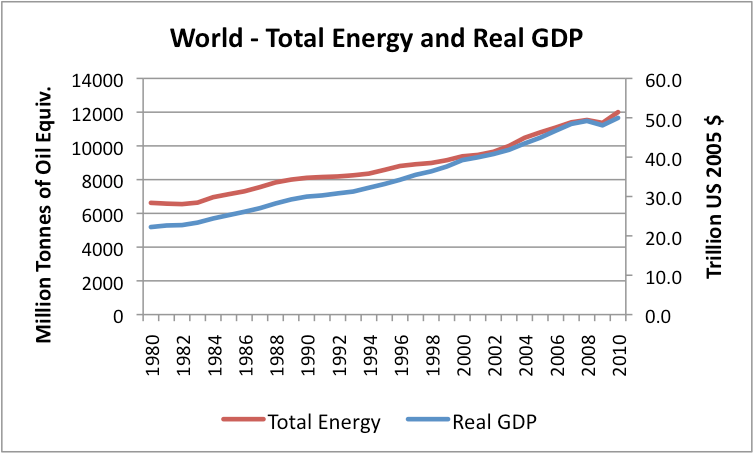

Electricity itself can be thought of as work. This becomes extremely clear when one looks at a graph comparing electricity consumption and GDP growth1.

Work applied wisely creates wealth. Electricity is fungible work2.

Aluminum and Bitcoin are both stores of used electricity and thus stores of performed work, because it took a lot of electricity to make them.

But why, then, is Bitcoin Green Energy? Currently it takes about a third of a trillion Joules on the most efficient equipment (enough to run that lightbulb for 1,100 years) to “mint” a bitcoin). How can that possibly be Green?

1. Bitcoin Stores Electricity

As shown above, Bitcoin stores the work electricity does, and much more directly than aluminum or other products do. Bitcoin is effectively is a store of electricity. More literal stores of electricity, like lithium-ion battery arrays, have huge capital costs, and while that ability to store energy is amazingly beneficial to the planet, you can’t easily ship that battery-stored energy. But make no mistake: storing electricity as Bitcoin is nearly the same as storing electricity in a battery economically. In both cases, you are just time-shifting electrical power to be used or exchanged at a later time.

2. Anyone Can Mine Bitcoin (Store Electricity) Anywhere Easily

Unlike world-class aluminum smelters, anyone can mine bitcoin if they have access to electricity and few thousand dollars to spend on miners. If I wanted to take advantage of Iceland’s very cheap electricity to make money from aluminum, I would need to invest many millions of dollars and many months or years to build a smelting plant and make my first aluminum ingot.

The barrier to Bitcoin mining however is very low. One can get started for just a few thousand dollars and usually requires little to now specialized construction. And this means that it can very easily locate (or re-locate) your electricity-to-Bitcoin operations to anywhere on the planet that has low-cost electricity.

3. Bitcoin Can Be Shipped Globally Easily and Quickly

The global average losses due to energy transport through wires is 8%, but most people don’t try to cross continents. But we can “ship” Bitcoin very quickly from Tampa to Timbuktu via the internet. Transaction costs for Bitcoin are getting higher, but if large amounts are transferred at a time, it is still a negligible cost. (Note that I am assuming Bitcoin is being used for energy-storage at a decent scale, not to buy a cup of coffee.)

A lot of people don’t yet really get this. Bitcoin can be created with electricity in Iceland, and then transferred to a person in Cleveland. That person in Cleveland can then buy heating oil or items produced by electricity (like a car) using Bitcoin. In essence, that stored work was created using electricity costs of $0.02/kWh in Iceland, instead of $0.13/kWh in Cleveland.

The person in Cleveland was not required to use only the resources of his local economy to create wealth, but was able to effectively “use” power that costs a lot less, and was generated in a much greener fashion, because Icelandic electricity is typically hydroelectricity.

There are many places on Earth, even quite close together, that simply cannot exchange electricity easily. The Texas power grid is largely separate from the Louisiana grid, and very separate from the Mexico grid. If a power plant in Turkey wanted to sell power into Syria, Israel, or Romania, it could not purely due to grid separations. But Bitcoin can pass quickly among many of those places…really among all places.

Thus, Bitcoin decouples electricity usage from electricity generation time and location.

This is insanely important for Green Energy, because the vast majority of electricity produced by solar, hydro, wind, and geothermal is NOT stored at all, currently. And even it it were, that electrical power can only be shifted in time (stored), not shifted in space (transported great distances). Bitcoin is a low capitol, low cost, instantly-shippable way to shift work demand to wherever and whenever the electricity is cheapest, and that is increasingly where the renewable sources are at certain times of day.

Even just in Europe, you can see that the average cost of electricity varies by a factor of 400%, and that doesn’t account for wild daily swings in electricity costs caused by renewables.

You can think of this as reducing the barriers that prevent the flow of demand from finding the lowest cost energy solutions. With Bitcoin, there are no grid barriers, power regulation barriers, or barriers related to the physics of distance (electricity transported across the globe via wires would be about half lost during transmission).

Now, 20 years ago, this might have been a bad thing for carbon dioxide production. Many countries such as China and Germany still used very cheap forms of coal that were many times more economical as power sources than wind or solar. Globalizing electricity demand would have likely meant a huge increase in coal burnt.

But now wind and solar power are often much cheaper than any coal source, at least at certain times of day. And the current inability to store grid-level amounts of power (gigawatt-hours or more) is still in its infancy. So those variable, renewable power sources often over-produce vs consumption, and that “green” power is simply wasted, completely unused.

With Bitcoin mining, we now have the ability to always make use of that excess power. Further, Bitcoin might actually encourage the building of more solar and wind farms, because now there is a way to make use of the excess power, turning a major detriment into a major win for utilities and customers.

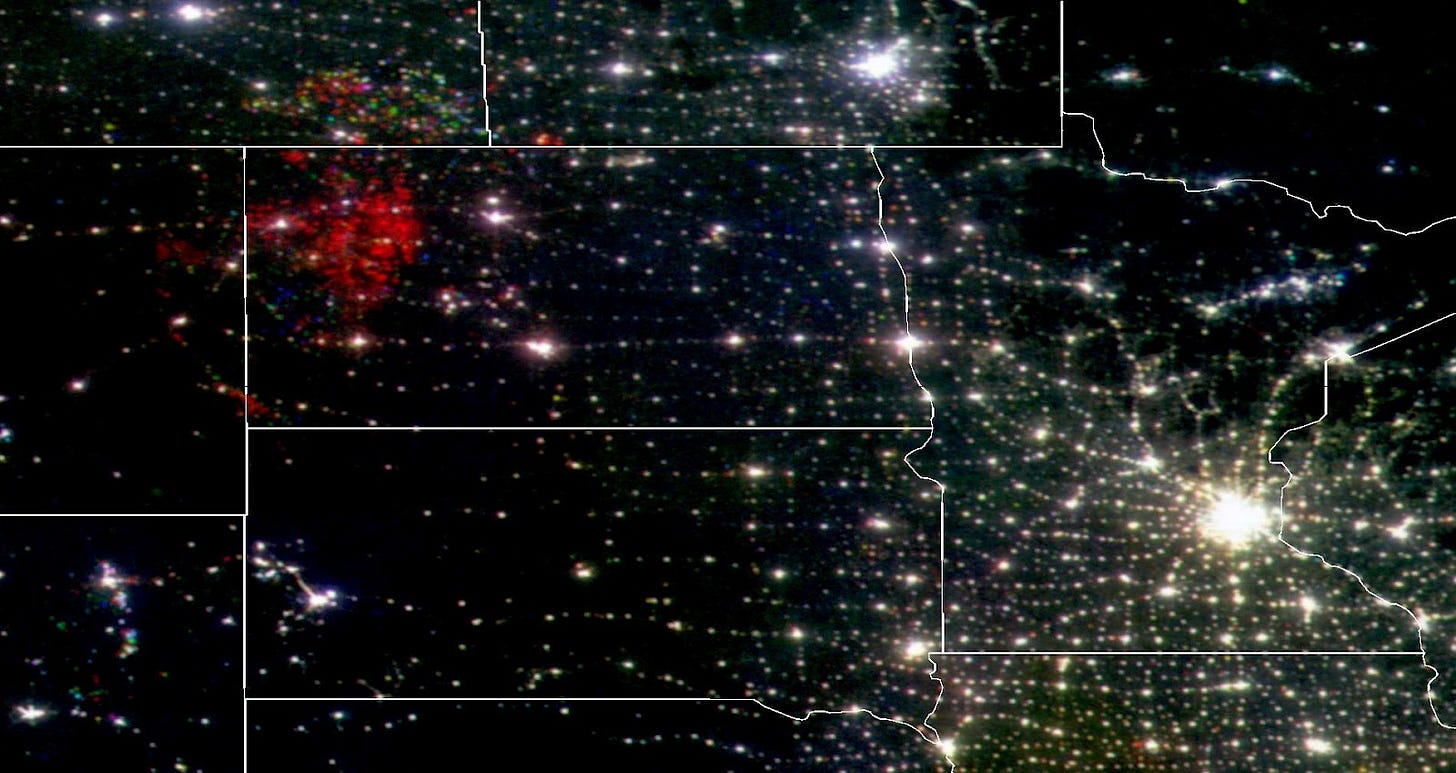

But what does this look like in practice? In many types of oil extraction, excess natural gas (mostly methane) is released as a byproduct. Until very recently, most of that gas was simply released into the atmosphere or burned in flames. This picture shows the US Midwest just 10 years ago at night. All the red light in western North Dakota shown below is flare gas being burned off as a waste product.

It was wasted instead of being collected because the volumes of gas at each small well were not big enough to justify running thousands of small extra pipelines to each well. But now, companies are learning to capture that thermal energy, convert it to electricity, and mine Bitcoin using excess would-have-been-flare gas.

El Salvador plans to use a volcano to mine Bitcoin via geothermal energy, and Iceland has been mining Bitcoin with geothermal energy for almost a decade.

But even if Bitcoin is mined using electricity made from nuclear power or natural gas, it is still a huge boon to the environment. It creates a global, open market for what is effectively stored electricity (stored work), and thus encourages investment in energy projects that produce the most efficient forms of electricity, even daily variable sources. As long as that power isn’t from coal (which is currently being burned to produce 37% of Earth’s power), then this is GREAT for our planet. The democratization of energy storage and transport enabled by Bitcoin will hasten the move away from coal, because lack of energy storage is one of the main reason coal is still used (due to the variability of supply during each day from wind and solar).

Objection A: What about all the electricity used to make Bitcoins?

87% of all Bitcoins are already created, and the vast majority of those were minted when it took much less electricity to mint them. Thus, those containers of value were much, much less energy intensive to create than modern bitcoins. But also, the current price of a Bitcoin is still two to three times higher than the endpoint market cost of the electricity it takes to mine it. At my house, I pay about 11 cents per kWh. It would cost me about $17,700 to mine a Bitcoin with Antminer S19s3. But that Bitcoin would be worth $43,000 at the time of the writing of this article. If I had mined it in 2015, it would have cost me less than $1,000 worth of electricity. And utilities mining Bitcoins would do so at the wholesale market rate, which is about 1/3 of what I pay at my house in the United States.

While the electricity used to mine modern Bitcoins is high, it’s still only a fraction of the value brought, making it not only a good storage option, but a quite profitable and thus attractive one. This makes the mining of Bitcoin a very active industry that rewards innovation, creativity, and finding the lowest cost (and thus most efficient) sources of power.

Further, I should re-emphasize that this electricity was going to be generated somewhere anyway. While some Bitcoins are definitely hoarded, they are increasingly being used not only by individuals, but also now by large institutions. That energy is in circulation doing work, and thus displacing work that would have otherwise been performed using dirtier and less efficient forms of electricity.

Objection B: But what about Bitcoin transaction costs?

Earlier this year, Bitcoin transaction fees did spike to $70 per transaction. Because this fee reflects blockchain computations, this does reflect a lot of energy usage. However, these fees have now fallen and stabilized below $2 for many months, reflecting again the long term typical costs.

But even at $70, that is only 1/600th of a bitcoin. As I said above, I would not necessarily recommend using Bitcoin every day to buy a cup of coffee, as $1.60 in transaction fees is still a bit much. But if large institutions or even small corporations are using Bitcoin as a globally fungible source of stored energy, then they will likely be moving around much larger lumps of Bitcoin, on the order of $10,000-$10,000,000 per transaction. The fees and the energy used to instantiate them would then be negligible, and well worth the benefits brought.

Remember, on average around 5% of the electricity coming to your house is lost in transmission lines, which compares very unfavorably to Bitcoin “transmission” costs (transaction fees).

Objection C: The Current Banking Systems Don’t Waste All That Energy

On a per-transaction basis, you are probably correct — Bitcoin uses more energy per transaction than your debit card does. Which is why, again, we shouldn’t use Bitcoin at Starbucks. But larger transactions make the marginal external carbon cost of such transactions negligible, as described a few paragraphs above.

Further, it is instructive to view the energy consumption of the banking industry now.

In the coming decades, Bitcoin and other cryptocurrencies will play perhaps the largest role of any technology in reducing the emissions of greenhouse gas, because they will make transitioning to any new energy source anywhere in the world fast and efficient and globally viable.

Bitcoin isn’t a threat to the environment or the power grid.

It’s merely a threat to Power.

In the last few decades, we have seen economic growth in more economically advanced companies begin to decouple from energy consumption somewhat due to those economies becoming more efficient and also them moving to a data-services based economics rather than just manufacturing and traditional services. Still, it is clear that for most parts of the world and until very recently everywhere, work creates wealth, and electricity is fungible work.

Electricity is measured literally in terms of work, which is power applied over time. You pay your electricity bill based on your kilowatt-hours, or thousands of watts (power) you used times the number of hours you used all those watts. But more intuitively, electricity can be used to run motors and smelters and sensors and computers to perform work that would have taken a lot of horses or humans to do 200 years ago. Electricity is very fungible work.

Using the Nicehash calculator, look at the price difference when electricity is zero cost vs my cost ($8.5 per day), then divide that cost per day by how much of a Bitcoin is mined that day (0.0004785). You get $17,700 or so.

https://www.nicehash.com/profitability-calculator/bitmain-antminer-s19

Brilliant article!